The Department of Education (DOE) published information in reference to the one-time debt relief of student loans announced by President Joe Biden. This debt relief consists in the cancelation of student loans in the amount $10,000 to students that earn $125,000 or less, or to households that earn less than $250,000. Students that have received the Pell grant may also receive an additional $10,000 in debt relief or student loan cancelation.

The debt relief applies only to loan balances you had before June 30, 2022. Student loans eligible for the debt relief include subsidized loans, unsubsidized loans, Parent PLUS loans, Grad PLUS loans and consolidated loans. Loans that are in “Default” are included with Stafford subsidized and unsubsidized, Parent Plus and Grad PLUS as well as Perkins loans under the DOE are also eligible for the debt relief.

How to Find Your Loans and Loan Servicer(s):

Log in to StudentAid.gov and select “My Aid” in the dropdown menu under your name at the top right of your screen.

The “My Aid” section will show you the servicer(s) for your loans.

The “Loan Breakdown” will show you a list of the loans you received. You’ll also see loans you paid off or consolidated into a new loan. If you expand “View Loans” and select the “View Loan Details” arrow under a loan, you’ll see the more detailed name for that loan (along with other information about it).

Direct Loans begin with the word “Direct.” Federal Family Education Loan Program loans begin with “FFEL.” Perkins Loans include the word “Perkins” in the name. If the name of the servicer starts with “Dept. of Ed” or “Default Management Collection System,” your FFEL Program loan or Perkins Loan is federally managed (i.e., held by ED). Only federal loans are eligible for debt relief. Private loans aren’t eligible and won’t show on your dashboard.

After You Apply:

1. You’ll receive an email confirmation.

After you submit your Student Loan Debt Relief Application, you’ll receive an email confirmation. Your StudentAid.gov account won’t show the status of your application.

2. The DOE will review your application.

Once you submit your application, the DOE will review it to confirm you’re eligible for debt relief.

3. The DOE will contact you if they need more information.

If the DOE does not have enough information on file to confirm your eligibility, we’ll email you with instructions. Here are some reasons we may follow up with you:

They need documentation to verify your income.You were enrolled as a dependent student anytime between July 1, 2021, and June 30, 2022, and they need information about your parent’s income.They can’t match you to our loan records based on the information you provided in your application.They determine that you don’t have any eligible federal loans.

If you don’t hear anything from the DOE, no further action is needed.

4. The DOE will notify you once your application is approved.

Once they confirm your eligibility, the DOE will notify you. They will determine how debt relief gets applied to your loans, and will provide this information to your loan servicer(s).

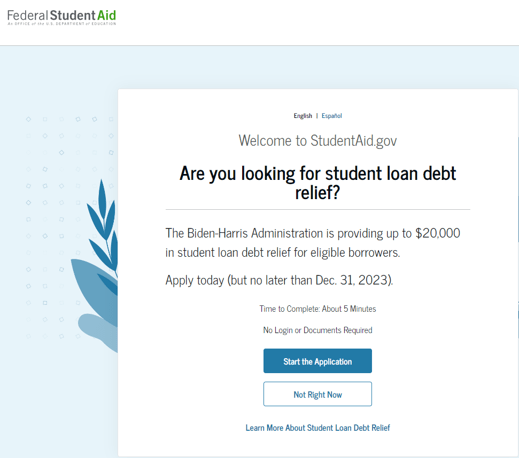

The application for the debt relief will be available online as of October, 2022.

5. The link to complete the application is as follows:

6. Get Help

StudentAid.gov has the latest information on the application process. If you need help filling out the form online or have questions related to your specific borrower situation, you can reach our contact center agents at 1-833-932-3439.

7. If you need additional assistance, please contact your Financial Aid Specialist at the Financial Aid Office.